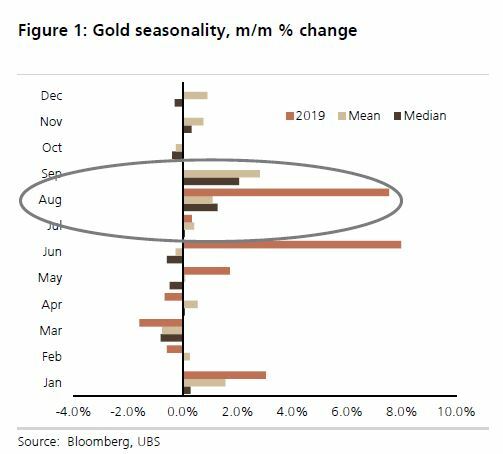

Gold has had a good third quarter, rising 8%, according to UBS. Two factors suggest gold may be set for further rises in the immediate future.

In India, the monsoon season brought higher rainfall than usual, which will boost agricultural incomes and thus drive increased purchase of gold.

Meanwhile in China, forward contracts have surged to record highs on the Shanghai Gold Exchange, and there has been a build-up in China gold ETF holdings since late May, suggesting a pick-up in investor interest.

Physical demand in China and India has been lacklustre due to the high prices, which are the highest consumers in China have faced since 2013 and near the all-time high for India. Higher import duties in India since July have not helped. But UBS' analysis suggests the demand issue is bottoming out and a turnaround may be on the cards.

"With gold prices holding well, the fear-of-missing-out is likely rising," said Joni Teves, strategist at UBS's global research team. "This is encouraging and implies that any downward pressure coming from macro factors over the remainder of the year is likely to be absorbed by fundamental demand."

UBS added that US-listed funds had been behind two-thirds (68%) of the inflows into gold ETFs so far this year.

"The continuation of gold's uptrend should eventually attract more investment interest as well as momentum buyers," said Teves.