Market movers today

- Fed Chairman Jerome Powell (voter, neutral) will speak again today at the 'Fed listens' event in Kansas . However, he will likely not bring much new compared to his speech yesterday. Minutes from the latest FOMC meeting will be released tonight . This will give insights into the discussion about the need for further accommodation. However, the meeting took place before the recent weak U.S. service PMI that points to some spill-over to U.S. consumers and the service sector.

- Also look out for any new comments regarding the upcoming U.S.-China trade talks starting tomorrow in Washington . We may also get more signals regarding possible Chinese retaliation against the U.S. blacklisting of more Chinese companies. However, China may wait until the other side of the trade talks this week before hitting back.

- In Scandi, we get Prospera inflation expectations in Sweden this morning and Norwegian GDP for August . We expect a decline of 0.3% m/m in line with consensus. More on Scandi on page 2.

Selected market news

Yesterday, the Brexit negotiations broke down and while it is normal for political negotiations to break down just before the deadline, this seems real. For PM Johnson it is a red line that all four nations of the UK leave the customs union while it is a red line for the EU and Ireland to avoid creating customs checks. The collapse of the negotiations also means that the blame game has started on both sides. A game changer could be a meeting between the Irish PM Varadkar and UK PM Johnson tomorrow or Friday but don't put your hopes too high We still believe we are heading for another Brexit extension followed by a snap election. Unfortunately, it is impossible to predict the outcome of such an election.

Fed Chair Powell said yesterday that the Fed will soon announce its plan to buy T-bills again in an attempt to calm money markets . While this would increase the Fed's balance sheet, Powell stressed it is not QE but because of the structural increase in demand for money, referring to it as "organic growth". Fed's Evans also said he "wouldn't mind another cut", supporting our call for a cut later this month.

Turkey has stated it will soon cross the Syrian border, which is likely to increase tensions between the US-Turkey-Syria (and perhaps eventually spill over to European politics).

President Trump has made it clear he will not cooperate with the House Democrats on the House impeachment inquiry. White House Counsel Pat Cipollone called the process "unconstitutional and invalid".

Scandi

In Norway, it is time for the monthly GDP-figure for August, where we expect a fall of 0.3% m/m after the strong growth in July at 1.0 % m/m. After the surprisingly weak manufacturing numbers, the risk is tilted to downside, but we need to see the number below -0.5 % m/m to take the three-month average below trend (0.5 %)

In Sweden, Prospera releases monthly money market inflation expectations at 08:00 CEST. Supposedly, forecasters at most banks and other parts of the financial community have revised down their inflation expectations going forward, which may show up in a further decline in October expectations. Last month, expectations stood at 1.6% in 1-2 years and 1.8% in 5 years, which are levels that at least to some members is already a concern.

Fixed income markets

Yesterday, Greece did a syndicated tap in the 10Y benchmark, where it sold EUR1.5bn. There were orders for EUR7.6bn and the bond was sold at a yield of 1.5%, which was a “new issue premium” of 6-7bp. Furthermore, relative to where it was trading before the announcement, it is a premium of almost 15bp. It shows again that there is plenty of value in participating in the syndicated deals.

There are more deals coming up. Ireland will do a syndicated tap in its Green bond in Q4. It could come next week already, given the very healthy budget for 2020 released yesterday, which shows a small budget surplus for 2020. The big uncertainty is the impact of a hard Brexit, but the Irish government said that in this case the surplus of 0.3% of GNI would turn to a deficit of 1% of GNI. Hence, we expect to see good demand at the upcoming Irish auction despite Brexit. See more in our preview on the Irish syndicated tap.

There is also the annual auction from City of Oslo. It is usually done in November and December, but this year it has been moved forward to October and November. It will sell in a new 10Y, a new 5Y and a new 15Y fixed rate benchmark. It will start with the 10Y Benchmark on 15 October, where it will sell NOK2bn. We expect it to be priced some 40bp above a matching 10Y NGB. Read more in our preview.

Fed chair Powell’s comments on the balance sheet indicate that the Fed will stabilise the front end of the yield curve. Powell was very keen to stress that this is not QE, but the effect on the US yield curve is likely to be the same. In our view, the trend for US points is downwards rather upwards going forward, as well as a steeper US yield curve.

FX markets

Powell’s comments on the balance sheet did not trigger a market response in either the FX or money markets, as investors were already widely expecting such an announcement at the next FOMC meeting. Also, there were no details of the plan. It should provide some comfort to the market that the Fed is ready to act to avoid tightening of liquidity conditions. EUR/GBP leaped yesterday to just below 0.90. In our view, another extension adds further upside pressure as 1) the economy remains challenged, 2) the BoE is more dovish and 3) an election would add political risk that has not yet been priced. In turn, the risk is probably shifting towards the idea that our short-term forecast of 0.90 is on the optimistic side. In essence, political uncertainty is only part of what makes the GBP weak – it is increasingly so also warranted by the negative drift in economic fundamentals.

EUR/DKK traded above 7.4690 yesterday and is close to the highs from H1 this year and well above the 7.46038 central rate. A wide discount in FX forwards has contributed to push EUR/DKK towards the top end of the historical trading range. Danmark’s Nationalbank (DN) has shown great patience with respect to the persistent weak DKK this year and we do not expect it to be in a hurry to intervene in FX markets to support the DKK. We look for the DKK to stay weak vs the EUR for the rest of the year.

We do not expect today’s Prospera survey (see Scandi section) to alleviate the pressure on the SEK and neither should tomorrow’s inflation numbers, barring a substantial positive surprise to our and market estimates. In the background, bearish global growth signals add headwinds to the krona. Our medium-term 11.00 target could be reached much faster than expected.

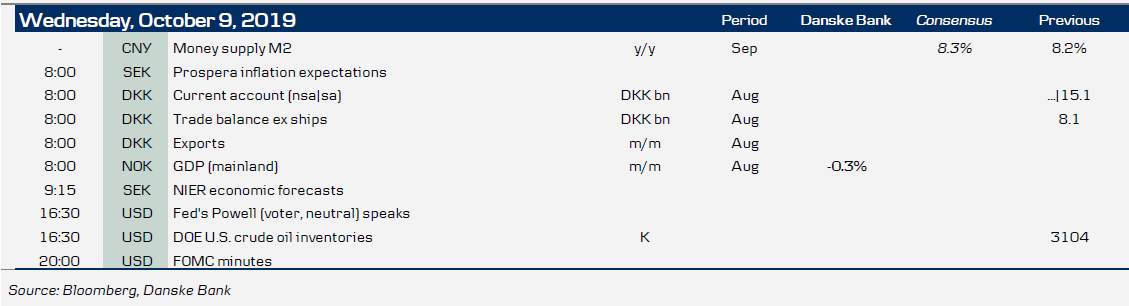

Key figures and events