How Much Gold Should I Hold?

To download PDF version of this article

I am asked this question often by both investors and advisors, and there is no simple answer.

First, you need to understand that gold is not an investment, but money itself. I wrote this article in 2017, and in January 2019, the Bank of International Settlements (BIS) implemented this policy for banks and central banks. They concluded that monetary gold is a zero-risk asset for central banks and banks, equal to US dollars and US Treasuries, because there is no counterparty risk, and it is highly liquid.

You also need to understand the unsupportable myths that have prevailed against gold.

At the root of our financial concerns is the insurmountable debt at government, corporate and personal levels globally, which will soon lead to a pension crisis. You also need to understand the magnitude of the pension crisis that we all, especially baby boomers, face. It has kept me up at night, and I am sure many are experiencing the same anxiety.

While some people may view this as doom and gloom, my philosophy is to get accurate information about reality, no matter how depressing it may be, and to make changes and adapt to that reality however possible, rather than just ignoring reality. As Ayn Rand famously said, “You can avoid reality, but you cannot avoid the consequences of avoiding reality.”

Your next challenge is to examine truthfully, with an open mind, your own personal biases: normalcy bias, complacency bias and cognitive dissonance. Many people don’t even realize they have these biases, but it is important to determine if you have them, and if you can overcome them. These often deeply ingrained biases may be holding you back from being successful and financially independent. If you cannot approach this subject with an open mind, you might as well stop reading now, because nothing I or anyone else can say will change your mind and persuade you take appropriate action.

If you are working with an advisor and you already have a balanced and diversified portfolio consisting of the best stocks, bonds and REITS, as well as physical gold and silver, and is sufficient to meet your retirement needs, an allocation of 10% to gold and 5% to silver should be enough to ensure you will do much better in the coming market crash. In this case, gold in your portfolio at a minimum of 10% will act as a portfolio hedge very much like insurance. If the rest of your portfolio goes down 50%, the 10% gold allocation could go up as much as 10-fold and will offset other portfolio losses (see our video on diversification).

To support this position, in 2005 BMG engaged Ibbotson and Associates to provide an analysis of proper portfolio diversification. Their conclusion: An investor can potentially improve the reward-to-risk ratio in conservative, moderate and aggressive asset allocations by including precious metals with allocations of 7.1%, 12.5% and 15.7%, respectively.

David Ranson, an assistant to then Treasury Secretary William E. Simon during the Reagan Administration, and president of Wainwright Associates, concluded that in order to protect an equity portfolio from inflation, you need an allocation of 40% to gold, and in order to protect a bond portfolio, you need gold allocation of 18%.

However, how much gold do you need if, like 50%+ of Canadians, you do not have enough savings or assets to meet your retirement needs In this case, you may need as much as 100% during the immediate short term, and 20% for gold and 10% for silver on an ongoing basis. Without this allocation, a typical portfolio of a 60/40 allocation to stocks and bonds will give you no chance of having a comfortable retirement or breaking even during the next market crash.

There is no rule that says you must always stay invested. There are times to take your money off the table, and sit it out if the risks are greater than the potential returns – today is one of those times. Hold your money in cash and, if you have enough knowledge and self-confidence, hold gold. Instead of experiencing painful portfolio declines and severe losses in your savings, you will be able to buy the best stocks at pennies on the dollar at the bottom of the correction.

Table 1: Performance of major indices from October 1,

Table 2: Performance of technology stocks from October 1,

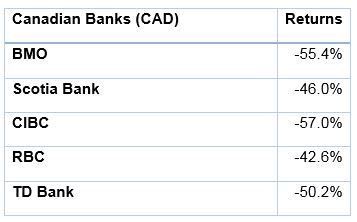

Table 3: Performance of Canadian banks from October 1,

Table 4: Performance of American banks from October 1,

If you sat out the market crash in cash and then invested two years later, you would have made a 2-fold return (216.6%) by January 31, 2019. If you held gold instead of cash, you would have made a 3-fold return (317.0%).

By trying to move to 100% cash or 100% gold, you will get resistance from your advisor and reallocating your traditional stock and bond portfolio to 100% gold will simply not be allowed by your dealer’s Compliance department unless your Know Your Client (KYC) form states that you can tolerate high risk. Most Compliance departments wrongly believe that gold is a volatile, high-risk asset, in direct contradiction to the BIS guidelines.

In order to implement this strategy, you will need to transfer your advisor investment accounts to Class D units of the BMG Gold BullionFund in a Discount Brokerage account (see How to buy BMG Funds). Most important, you will need to spend the time educating yourself in order to overcome your biases and gain the knowledge to be comfortable with your decision. To fast track the learning process, please go to the Market Insight section of the BMG corporate website and also visit the BMG DIY website for more information as well as the video sections. Please subscribe to the free newsletters listed on the right side-bar of the DIY site.

To get a thorough understanding of gold, please purchase a copy of my book, $10,000 Gold – Why Gold’s Inevitable Rise is the Investors Safe Haven.

In addition, Jim Rickards (lawyer, economist and investment banker) is the author of four best-selling books: Currency Wars, The Death of Money, The Road to Ruin and The New Case for Gold.

These books are must-reads for anyone interested in preserving their wealth or ensuring they have a comfortable retirement.

Recently, Jim gave a seminar in Adelaide, Australia. His presentation, Gold: The Once and Future Money, looks at how the monetary system really works, how it connects with

Although it is 1.5 hours long, with a

Q&A section at the end, Jim does an excellent job of explaining history,

the monetary system, why gold has always been money and a safe haven in

treacherous times—and will continue to be—but at much higher prices.

It is important to take the time to view this excellent presentation.

Please ensure you are subscribed to our free newsletter, the BullionBuzz, where I provide articles that do not appear in the mainstream media and that are written by some of the most astute financial authors in the world.

Please feel free to call us at (888) 474-1001 or email us at info@bmg-group.com with any questions or comments.

Nick – I have great respect for both you and James Rickards. I have read all four of his books and yours “Gold at $10,000.00”. Seems to me you were calling the $10,000.00 peg long before Mr. Richards but you both came to the same logical prediction. Many call Bullion money, some call it insurance, some call it a hedge but I call it peace of mind.

Pingback: How Much Gold Should I Hold? - munKNEE.com